Tax and Structures

Comparison of all entities

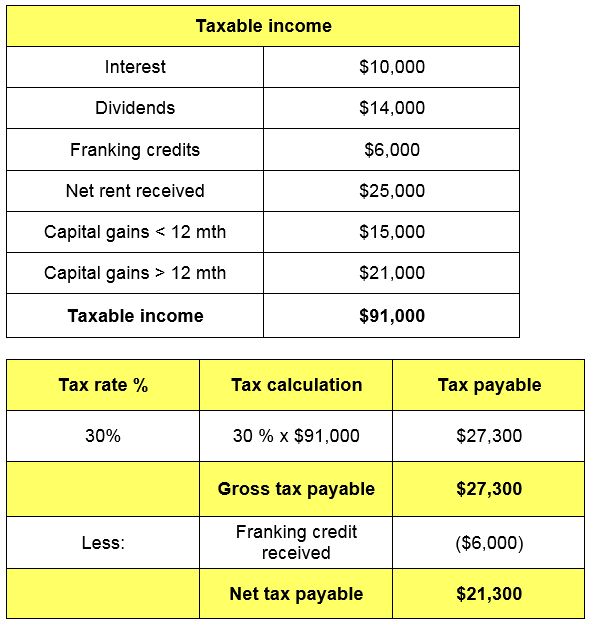

Tax for a company

The tax for Australian companies is a flat 30% on all income, unless it is a small business entity with a turnover under $50 million and qualifies for the lower company tax rate of 27.5%.

The company doesn’t receive a discount for any capital gains. In this example the company only conducts investment activities and does not run a business, so tax still applies at 30% (or 27.5% for small business entities).

The taxable income for the company is shown in the top table.

The tax payable by the company in 2018/19 is $21,300, as shown in the second table (or $19,025 for small business entities).

Note: if this money was subsequently paid as a dividend by the company to shareholders, there may be further tax to pay by the shareholders if they have a marginal tax rate higher than the company tax rate.