Tax and Structures

Comparison of all entities

Tax for a super fund

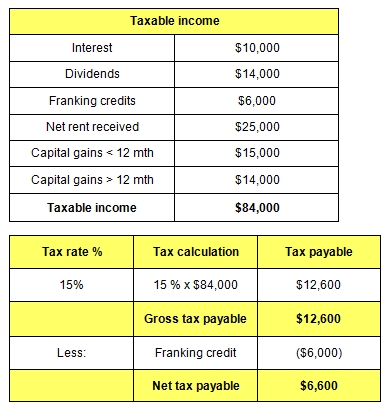

The capital gain for investments held more than 12 months is reduced by one-third, resulting in the taxable capital gain being $14,000 (2/3 x $21,000).

The taxable income for the super fund is summarised in the table opposite.

The tax for the super fund in 2018/19 is shown in the second table.

Note: There would currently be no tax to pay if the super fund was in the drawdown (pension) phase; this is further explored in the superannuation module.

In fact, if the super fund was in pension phase with a tax rate of zero, the franking credit of $6,000 will be refunded in cash to the super fund by the ATO.

Page 40 of 54